Competitors

1. Global Production

France, Italy and Spain are representing 48.19% of the global wine production but have experienced low level of growth during the last ten years.

Global wine production levels off since 2007 and remains relatively constant around 270 Miohl. However, it can easily be observed that the growth rate of the “Old World” countries is very low compared to “New World” countries such as Chile, Australia, South Africa or New Zealand. While historic leaders, Italy, France and Spain are slowly losing ground, “New World” producers are growing:

-

Moderately: United States lost 7.6% in 2000-2007 but recorded a 10.8% growth in 2007-2014, Argentina increased its production by 20.0% in 2000-2007 but staid still in 2007-2014 (+1%) and China gained 19.0% in 2000-2007 but reduced its production by 10.6% in 2007-2014.

-

Strongly: Chile’s production keeps rising steadily, by 23.3% in 2000-2007 and by 27.63% in 2007-2014, thanks to its low production costs; Australia follows the upward trend with a 19.3% growth in 2000-2007 and a 24.95% growth in 2007-2014, South Africa recorded a 40.8% solid growth in 2000-2007 but only 15.7% in 2007-2014. The big winner is New Zealand whose production skyrocketed by 145.6% in 2000-2007 and by 117.1% in 2007-2014.

Production in the top-9 markets (New Zealand added)

2. Value Chain

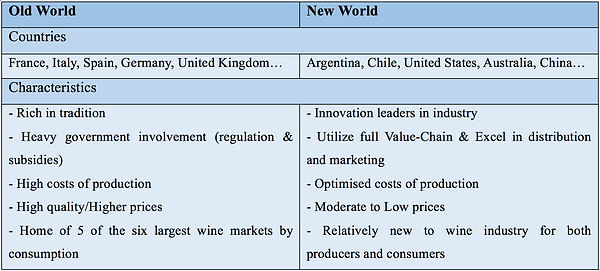

“New World” countries (USA, Chile, South Africa, China, New Zealand, Argentina…) have adapted their value chain in order to produce affordable wines. As their wine industry is highly concentrated and customer-oriented, their current objective is to offer low prices wines with the best value for money. In the past, the “New World” countries where considered to produce “wines of thirst” without any epicurean dimension. Their vision is focused on the grape instead of the region. “New World” wines are produced through a blend of grape varieties from different soils or different harvests and are sold under different brand names.

Old World countries (Italy, France, Spain…) have historically constructed their value chain in order to deliver high quality wines at moderate-high prices. Wine industry is spread over large areas which increases production costs although gathering trends are slowly emerging allowing producers to generate more significant economies of scale. Given their high production costs, they capture value through high quality wines and through “authenticity and tradition”. Their vision is focused on the cultural side and their production is thus highly regulated (“appellation contrôlées” and wines of “terroir”).

Usual wine value chain

Average cost of wine in New World countries vs. Old World countries

3. Competitive advantages

Simplification of the offer could provide a better insight for the new consumers but French wine sector seems to be very attached to its local tradition. This complex labelling practice is still an obstacle in world wine industry. Nevertheless, “Old World” producers were the first to define tastes and quality standards while “New World” producers worked hard to build their wine industry. Yet “New World” producers have recently been successful in producing consistent quality wine and in capturing global market share. French wine producers are starting to respond but the trend is not fully established. Moreover, geographical dispersion and poor market concentration tends to increase its cost of structure.

France benefits from an important domestic market but with limited growth potential – albeit constituting a solid customer base - for the last decades. Nevertheless, France’s currency is stable and has an industry-friendly climate that attracts foreign investment.

3. Competitive advantages

Simplification of the offer could provide a better insight for the new consumers but French wine sector seems to be very attached to its local tradition. This complex labelling practice is still an obstacle in world wine industry. Nevertheless, “Old World” producers were the first to define tastes and quality standards while “New World” producers worked hard to build their wine industry. Yet “New World” producers have recently been successful in producing consistent quality wine and in capturing global market share. French wine producers are starting to respond but the trend is not fully established. Moreover, geographical dispersion and poor market concentration tends to increase its cost of structure.

France benefits from an important domestic market but with limited growth potential – albeit constituting a solid customer base - for the last decades. Nevertheless, France’s currency is stable and has an industry-friendly climate that attracts foreign investment.

Old World vs. New World Characteristics

4. Exportations

Global exports have grown from 67.9 in 2002 to 104.3 Miohl in 2015, which represents a 50% increase over the last decade. As previously noted France is the biggest exporter in value but only the third in volume.

Global wine exports